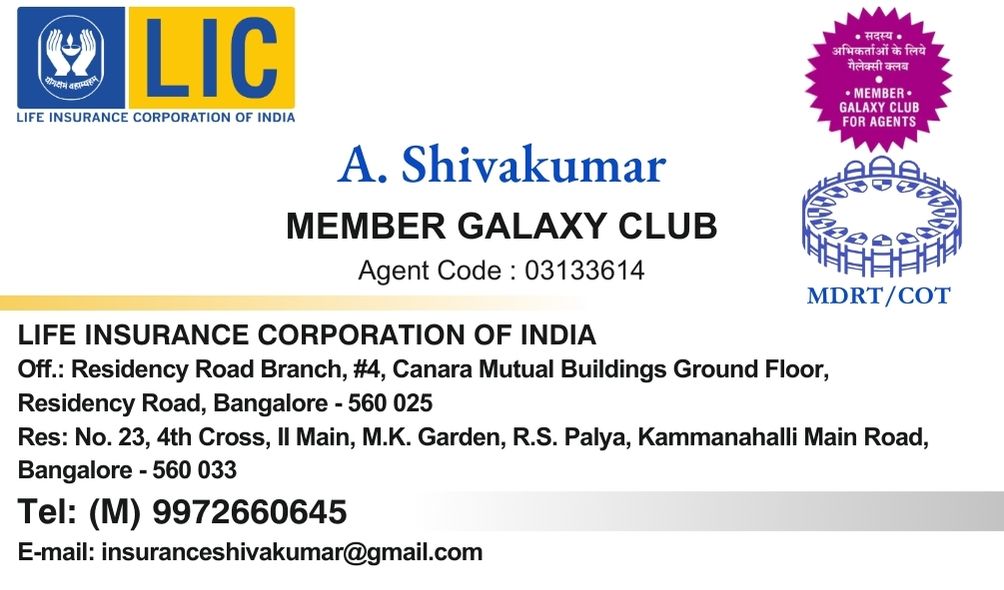

LIC New policy buy 9972660645

In the realm of financial planning, few decisions hold as much significance as purchasing a new Life Insurance Corporation of India (LIC) policy. With its legacy of trust and reliability, LIC offers individuals a pathway to safeguarding their loved ones’ futures and realizing their long-term financial goals. This article serves as your comprehensive guide to buying a new LIC policy, empowering you to make informed decisions that resonate with your aspirations.

Why Invest in LIC: The Foundation of Stability LIC stands tall as India’s leading insurance provider, renowned for its unwavering commitment to policyholders and steadfast financial stability. With a diverse portfolio of insurance products catering to various needs and preferences, LIC offers individuals the assurance of financial security and peace of mind.

Key Considerations When Buying a New LIC Policy:

1. Assess Your Financial Goals: Before diving into the array of LIC policies, take a moment to reflect on your financial aspirations. Are you seeking protection for your family’s future? Planning for your child’s education? Or perhaps building a corpus for your retirement? Understanding your goals will guide you towards choosing the most suitable LIC policy.

2. Understand Policy Types: LIC offers a range of policies, including term insurance for pure protection, endowment plans for savings with insurance, and unit-linked insurance plans (ULIPs) for investment opportunities. Each policy type comes with its unique features and benefits, so it’s essential to understand them before making a decision.

3. Evaluate Coverage and Benefits: Carefully review the coverage and benefits offered by each LIC policy. Consider factors such as the sum assured, maturity benefits, bonus facilities, and riders or add-ons available. Ensure that the policy aligns with your financial needs and provides adequate protection for your loved ones.

4. Calculate Premiums and Affordability: Calculate the premiums associated with your chosen LIC policy and assess their affordability. While it’s crucial to have sufficient coverage, it’s equally important to ensure that the premiums fit comfortably within your budget. Use LIC’s premium calculators and consult with a licensed agent if needed to determine the most suitable premium amount.

5. Seek Expert Advice: Navigating the world of insurance can be complex, especially for first-time buyers. Consider seeking advice from a licensed LIC agent or financial advisor, who can provide personalized recommendations based on your financial situation and goals. An experienced advisor can help you navigate through the policy options and make informed decisions.

Conclusion: Investing in a new LIC policy is not just about purchasing insurance; it’s about securing your financial future and protecting your loved ones’ well-being. By understanding your financial goals, evaluating policy options, and seeking expert advice, you can embark on this journey with confidence and clarity. Take the first step towards financial security today by buying a new LIC policy that aligns with your aspirations and unlocks a world of possibilities for the future.