Mutual Funds

Mutual Funds Sahi Hai

The investment pattern has changed for those who want to invest. Today there are plenty of options for the

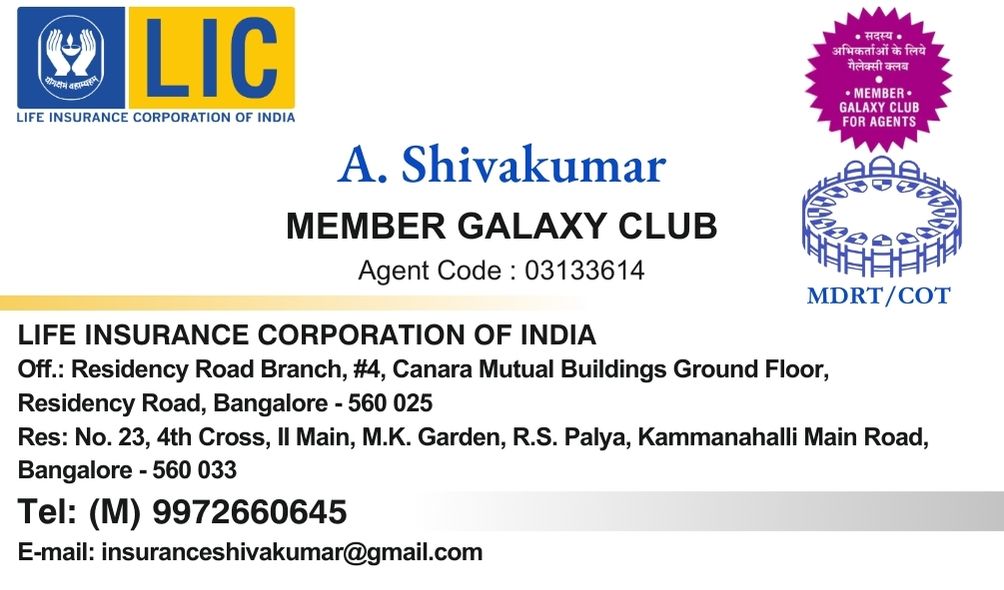

working class and Business class. In those days, LIC Plans and Bank Fixed Deposits were the most popular Investments for anyone who wanted to save for the future. Still, most of us are confused with the working of Mutual Funds. There is a kind of fear among investors to start the investment in Mutual Funds or not.

Diversification is the key to success

Invest in all financial products where you find good return over the time. The most benefited peple are those who diversified their investments. Keeping all Investments at one place is never suggested. Diversify your investment in Insurance, Mutual Funds, Fixed Deposits, Shares, Gold etc. By diversifying the investment, the risk on returns is reduced.

You need a good Advisor to diversify your fund into four to five instruments and get good returns.

To invest in any Mutual Fund, invest in shares, call 9886568000

Large Cap

Large Cap

Large Cap

Large Cap Among all listed companies, top 100 companies in terms of market value

Mid Cap

Mid Cap

Mid Cap

Mid Cap After first 100 big companies in terms of valuation, 101st to 250th companies

Small Cap

Small Cap

Small Cap

Small Cap After first 250 big companies, 251st company onwards

Mutual Funds Tax Rules

- If a fund is stopped and the investment is withdrawn with 1 year, then Short term Capital gain Tax would be 15% + cess + surcharge. At the same time if the redemption is done after one year from the date of investment, upto Rs. 1,00,000/- is tax-exempted. All profit withdrawal of more than Rs. 1,00,000/- would attract Long term capital gain tax of 10% + cess + surcharge.

- Equity Linked Savings Scheme which is mainly for tax savings, cannot be withdrawn within 3 years from the investment date.

- The moral is, don’t let the market spook you into getting off your investment track. A SIP will work in all market cycles. It will work exceptionally well when the market sees a correction. There is only one scenario when a SIP won’t work, that is when you stop it.