LIC buy policies online

In the bustling city of Bangalore, amidst the dynamic financial landscape, LIC of India stands as a beacon of stability and trust. With a legacy spanning decades, LIC continues to be a preferred choice for millions seeking financial security and growth. In this comprehensive guide, we delve into LIC Bangalore’s diverse array of investment solutions, offering insights into LIC new policies, LIC tax-saving plans, LIC child education, all mutual funds SIPs, how to start home loan interest waiver mutual funds SIPs, pure term insurance plans, LIC guaranteed pension plans, and LIC lifetime fixed income plans.

LIC’s New Policy Offerings

LIC’s new policy offerings provide a gateway to financial protection and growth. From endowment plans to ULIPs, these policies cater to diverse needs, offering a blend of insurance and investment benefits. Bangalore residents can secure their future with policies tailored to their life stage and financial goals.

Tax-Saving Plans: Maximizing Returns, Minimizing Liabilities

LIC’s tax-saving plans are instrumental in optimizing tax benefits while ensuring wealth creation. Residents of Bangalore can leverage these plans to reduce their tax liabilities while building a corpus for the future. With options like LIC’s Jeevan Anand and Jeevan Labh, individuals can enjoy dual benefits of insurance coverage and tax savings.

Child Education Plans: Investing in Your Child’s Future

For parents in Bangalore, securing their child’s education is paramount. LIC’s child education plans offer a systematic approach to building funds for educational expenses. Whether it’s higher education abroad or professional courses, these plans provide financial support at every step of the journey.

Mutual Funds SIPs: Beating Inflation with Systematic Investments

In a rapidly evolving economy, beating inflation is a challenge. LIC’s mutual funds SIPs offer a disciplined approach to wealth creation, allowing investors to benefit from rupee cost averaging and compounding. Bangalore residents can choose from a range of equity, debt, and hybrid funds to build a diversified portfolio aligned with their risk appetite and financial goals.

Home Loan Interest Waiver Mutual Funds SIP: Smart Saving for Homeowners

Owning a home in Bangalore is a dream for many. LIC’s home loan interest waiver mutual funds (SIP) provide a unique opportunity for homeowners to save on interest payments while building wealth for the future. By investing systematically, individuals can reduce the burden of home loan EMIs and create a corpus for other financial goals.

Term Insurance Plans: Protecting Loved Ones’ Financial Future

Life is unpredictable, but LIC’s term insurance plans offer a safety net for loved ones. Bangalore residents can secure their family’s financial future with affordable and comprehensive term insurance coverage. With options for riders and additional benefits, these plans provide peace of mind amidst life’s uncertainties.

Guaranteed Pension Plans: Securing Retirement with Confidence

Retirement planning is essential for a secure future. LIC’s guaranteed pension plans offer retirees in Bangalore a steady income stream post-retirement. With the assurance of regular payouts and tax benefits, individuals can enjoy their golden years without financial worries.

Lifetime Fixed Income Plans: Ensuring Financial Stability

For those seeking stability and predictability, LIC’s lifetime fixed income plans are ideal. Bangalore residents can enjoy a regular income stream for life, ensuring financial stability during retirement and beyond. With competitive interest rates and flexibility, these plans offer a reliable source of income in an uncertain world.

LIC Bangalore’s comprehensive suite of investment solutions caters to the diverse needs of individuals and families. Whether it’s securing your family’s future, saving taxes, or planning for retirement, LIC offers a range of products designed to provide financial security and growth. For personalized advice and guidance, consult with an experienced LIC agent to embark on your journey towards financial freedom.

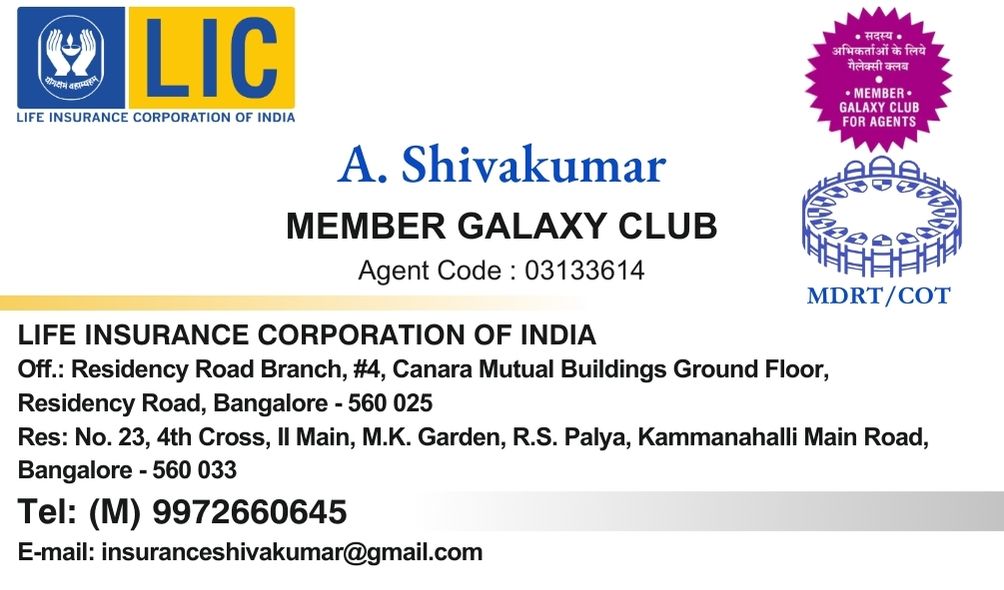

Know Shivakumar before buying the LIC life insurance plan