LIC JEEVAN UMANG Policy

LIC Jeevan Umang is a non-share market-linked, participating, individual, whole life assurance plan which offers a combination of Income and Protection to the family.

This plan provides 8% sum assured as cash back from the end of the premium paying term till maturity and a lump-sum payment at the time of maturity or on death of the policyholder during the policy term. The cash back payable is dependent on the SUM ASSURED of the policy.

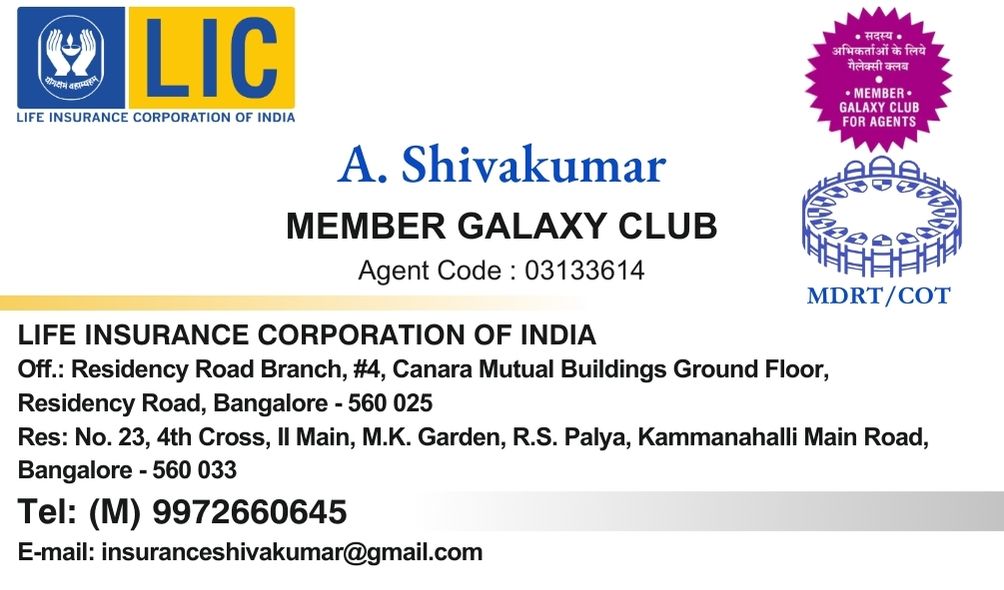

Call 9972660645 to buy this plan

AGE AT ENTRY | 90 Days (Completed) |

PREMIUM PAYING TERM (PPT) | 15, 20, 25, & 30 Years |

Maximum Age at Entry in Years | 55 for 15 PPT |

AGE AT MATURITY | 100 Years (Nearest Birthday) |

POLICY TERM | 100 – Age at Entry |

BASIC SUM ASSURED | 2,00,000 and above in multiples of 25,000 |

PREMIUM PAYING MODE | Yearly, Half Yearly, Quarterly & Monthly (SSS and NACH Only) |

PREMIUM PAYMENT MODE REBATE | 2% on yearly, 1% on Half Yearly, Nil on Quarterly & Monthly |

Premium discounts under in LIC Jeevan Umang policy

Mode Rebate: Rebate given based on the premium payment mode chosen.

It is recommended to pay LIC premiums in a yearly mode to get the benefit of the yearly discount.

| Premium Payment Mode | Percentage(%) |

|---|---|

Yearly Mode | 2% |

Half yearly Mode | 1% |

Quarterly and Monthly | Nil |

Benefits under LIC Jeevan Policy

Maturity Benefits

LIC Jeevan Umang policy Maturity Benefit = Sum Assured on Maturity + Vested Simple Reversionary Bonuses + Final Additional Bonus (FAB).

Survival Benefits

On the policyholder surviving to the end of the premium paying term, provided all premiums have been paid, a survival benefit equal to 8% of the Basic Sum Assured shall be payable each year. The amount receivable is 100% Tax Free. The first survival benefit payment is payable at the end of the premium paying term and thereafter on completion of each subsequent year till the Life assured survives or till the policy anniversary prior to the date of maturity, whichever is earlier.

Sum Assured on Maturity: On Survival to the end of the policy term, the Sum Assumed on Maturity, Vested Simple Reversionary Bonuses, and Final Additional Bonus if any will be paid.

All returns from LIC of India under this plan is 100% Tax-free for the policyholder and in case of any claims for nominees also it is tax-free.

LIC AGENT BANGALORE 9972660645

Death Benefits

LIC Jeevan Umang policy 945 Death Benefit = Sum Assured on death + Vested Simple Reversionary Bonuses + Final Additional Bonus (FAB).

- Sum Assured on Death: On the death of the policyholder during the policy term, Sum Assured on death, Vested Simple Reversionary Bonuses, and Final Additional Bonus will be paid.

- The sum Assured on Death is 7 times higher than the annualized premium.

- Death Benefit: The Death Benefit shall not be less than 105% of the total premium paid as of death.

Eligibility

Loan: A policy loan is available after paying 2 years’ full premium and the beginning of 3rd year

Surrender period: Policy can be surrendered after 2 years, at least 2 full years’ payment of premiums.

LIC Jeevan Umang plan is recommended for Children, Grandchildren, working, and Business people to safeguard their future. The Tax-free returns after the premium paying term work like a Pension till life. The nominee is also not required to worry as the death benefits, in case of any eventuality, would be paid to them.

To buy LIC Jeevan Umang Policy, call 9972660645