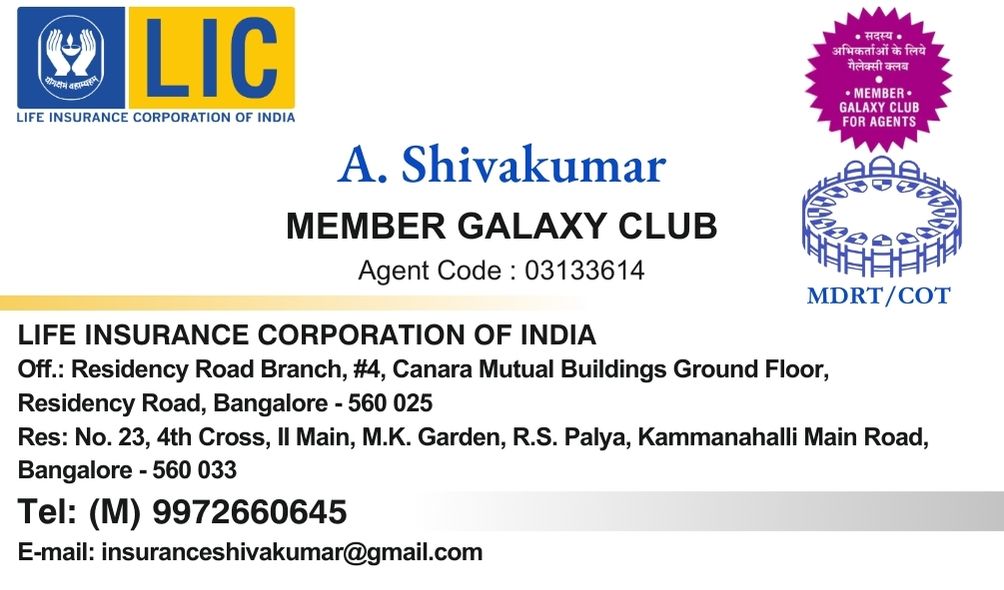

Welcome to LIC Plans,

In LIC of India, we have plans to insure all your happy moments. Buying an Insurance policy online is very easy. But when the claims come, no one would be around you. Life insurance is intangible and requires servicing at every stage. Call me at 9972660645 for any LIC policy in India and abroad

The Popular LIC Plans

Endowment Plans

Whole Life plans

Retirement Solutions

Pure Protection Plans

ULIP

Life Insurance

Fun is like life insurance; the older you get, the more it costs.

Life insurance is commonly known as life assurance. It is an agreement between the consumer and the insurer, where the insurance company offers financial protection or coverage to your family so that they can continue to lead a stable life even in your absence. The payment regarding terminal illness and critical illness depends upon the norms of the insurer. The consumer pays a specified premium amount in a lump sum or at regular intervals. Here, your life cover premium depends upon various factors such as age, gender and health condition.

The right term plan to secure your family's future.

Get your spouse an option of ‘better half’ benefit that provides an additional life cover for them when you are not around, ensuring complete security for the entire family. This time, don’t just commit to them for life… Go beyond that.

Documents Required To Buy Life Insurance

- Age Proof ⇒ Birth Certificate, 10th or 12th mark sheet, Driving License, Passport, Voter ID, etc.(Anyone)

- Identity Proof ⇒ Driving License, Passport, Voter ID, PAN Card, Aadhaar Card, which proves one’s citizenship.

- Address Proof ⇒ Electricity Bill, Telephone Bill, Ration Card, Driving License, Passport, should clearly mention the permanent address(Anyone).

- Income Proof → Income proof specifies the income of the person buying the insurance.

- Proposal Form → Duly filled in the proposal form is required.

- Medical Tests ⇒ Some companies may require medical check-ups in order to make sure that the insured does not suffer from any chronic illness.