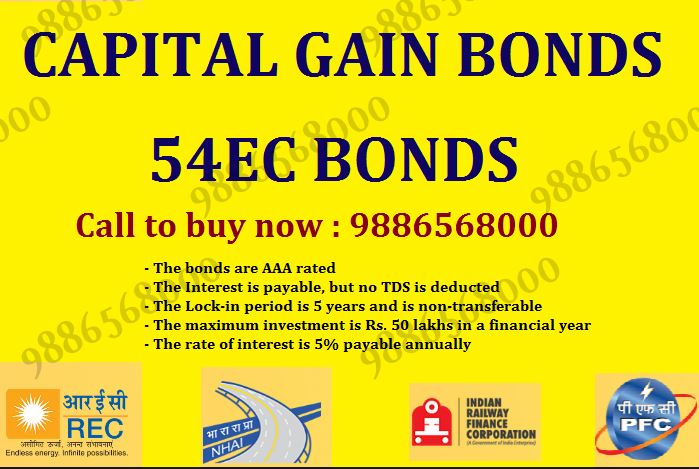

Capital Gain Bonds 54 EC Bonds

Investing in capital gain bonds, also known as Section 54EC bonds, can offer several benefits, especially for individuals who have recently made capital gains from selling assets such as property or stocks. A kind of investment instrument authorized by the Income Tax Act, 1961. 54EC Capital Gain Bonds provide an opportunity for individuals to save on long-term capital gains taxes incurred from the sale of their property or assets. Here are some reasons why people might consider buying these bonds:

- Tax Exemption: One of the primary reasons for investing in Section 54EC bonds is to avail of tax benefits. Under Section 54EC of the Income Tax Act, if an individual invests the capital gains from the sale of a property or certain other assets into these bonds within a specified time frame (usually within six months of the asset sale), they can claim an exemption on the capital gains tax. This helps in reducing the overall tax liability.

- Fixed Returns: Capital Gain Bonds offer fixed returns over a specified period. This can be attractive for investors looking for stable and predictable returns, especially in comparison to volatile investment options such as stocks or mutual funds.

- Long-term Investment: The lock-in period for these bonds is typically three years. Therefore, investors should have a long-term investment horizon when considering these bonds. However, the tax benefits provided can outweigh the longer lock-in period for many investors.

- Diversification: Investing in Capital Gain Bonds can also help in diversifying one’s investment portfolio. By allocating a portion of their capital gains into these bonds, investors spread their risk across different asset classes, which can help in managing overall portfolio risk.

- Supporting Infrastructure Development: The funds raised through these bonds are often utilized by government bodies for infrastructure development projects such as building roads, highways, bridges, and other public amenities. Therefore, investing in these bonds indirectly contributes to the development of essential infrastructure in the country.

Before investing in capital gain bonds, individuals should carefully consider their investment goals, risk tolerance, and tax implications. Consulting with a financial advisor or tax consultant can also provide personalized guidance based on individual circumstances.